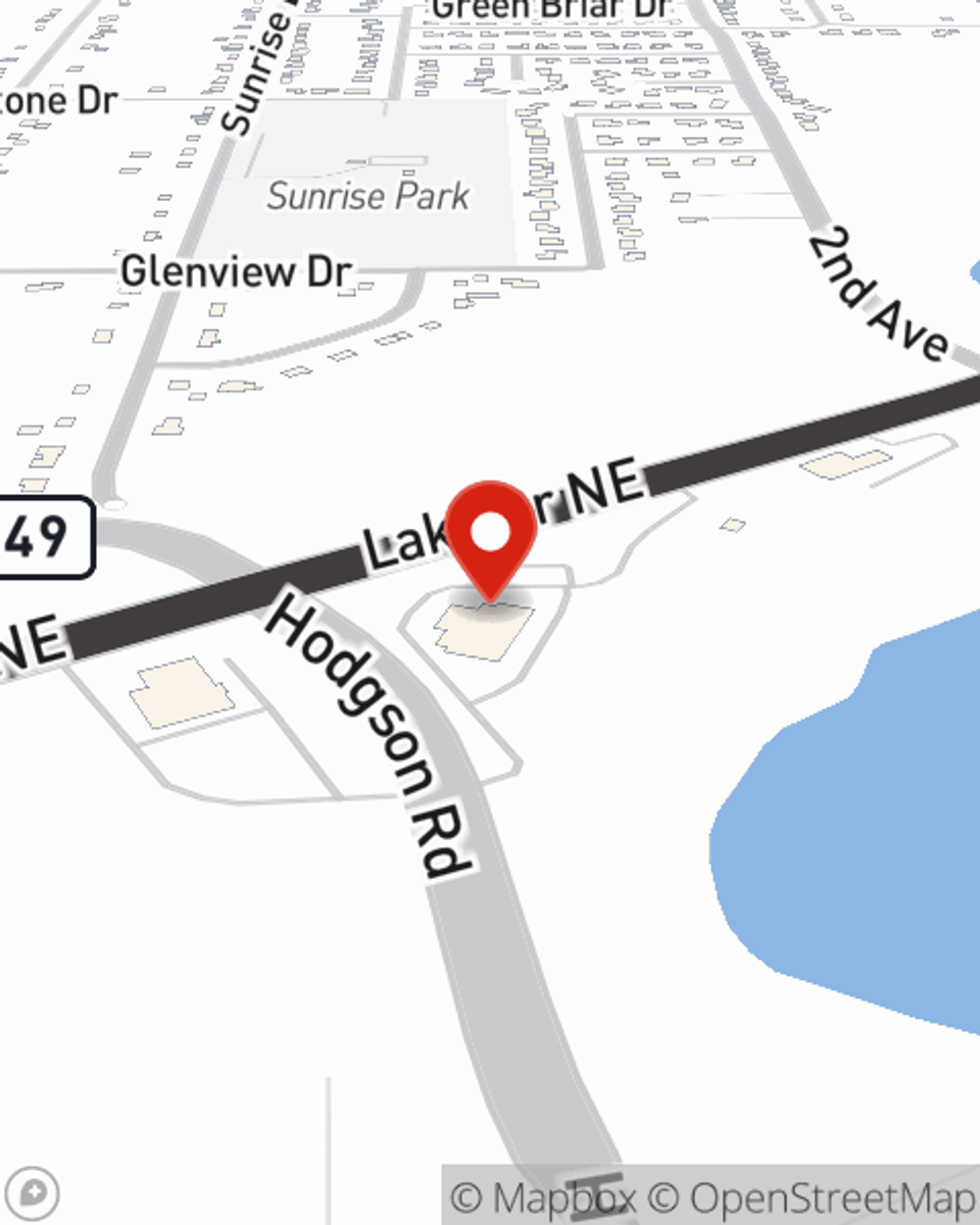

Business Insurance in and around Lino Lakes

Lino Lakes! Look no further for small business insurance.

Cover all the bases for your small business

Business Insurance At A Great Value!

When you're a business owner, there's so much to remember. We understand. State Farm agent Jen Korus is a business owner, too. Let Jen Korus help you make sure that your business is properly insured. You won't regret it!

Lino Lakes! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a photographer or an acupuncturist or you own a shoe repair shop or an auto parts shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Jen Korus. Jen Korus is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

Visit the terrific team at agent Jen Korus's office to discover the options that may be right for you and your small business.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Jen Korus

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.